Meta Description:

“Discover the best investment opportunities for beginners in the UK.

Learn how to start, compare options, and grow your wealth effectively in 2024.”

Introduction

Investing can seem daunting, especially if you’re just starting out. But in the UK, there are plenty of beginner-friendly investment opportunities that can help you grow your wealth over time.

Whether you’re saving for retirement, a house, or simply looking to make your money work harder, this guide will walk you through the best investment options for beginners in the UK.

We’ll cover everything from stocks and shares ISAs to property investments, providing you with the knowledge and confidence to start your investment journey in 2024.

Understanding Investment Basics

Before diving into specific opportunities, it’s important to understand some core concepts:

What is Investing?

Investing means allocating money to assets (e.g., stocks, property) with the expectation of generating profit over time.

Unlike saving, investing involves risk but offers higher potential returns.

Key Principles for Beginners

- Start Early: The earlier you start, the more time your money has to grow through compound interest.

- Diversify: Spread your investments across different assets to reduce risk.

- Risk Tolerance: Assess how much volatility you can handle.

- Tax Efficiency: Use tax-efficient accounts like ISAs to maximize returns.

Top Investment Opportunities for Beginners in the UK

1. Stocks and Shares ISA

What is it?

A tax-free account allowing investments in stocks, funds, and ETFs. Annual allowance: £20,000 (2024).

Pros:

- Tax-free growth and withdrawals.

- Flexible access to funds.

- Wide range of investment choices.

Cons:

- Market risk varies by asset.

How to Start:

Open an ISA with platforms like Vanguard or Hargreaves Lansdown.

2. ETFs and Index Funds

What are they?

ETFs (Exchange-Traded Funds) track markets (e.g., FTSE 100). Index funds mirror specific indices.

Pros:

- Low fees and instant diversification.

- Passive investing suits beginners.

Cons:

- Limited outperformance of the market.

Example:

The Vanguard FTSE Global All Cap Index Fund has returned ~7% annually over 5 years.

3. Robo-Advisors

What are they?

Automated platforms like Nutmeg or Wealthify that manage portfolios based on your goals.

Pros:

- Low minimum deposits (£500 or less).

- Hands-off approach.

Cons:

- Management fees (~0.7% annually).

4. Property Investments

Options:

- REITs (Real Estate Investment Trusts): Invest in property portfolios without buying physical assets.

- Buy-to-Let: Purchase rental properties (higher capital required).

UK Hotspots:

Manchester and Birmingham offer rental yields of 5-7%.

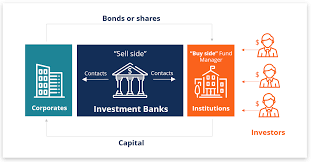

5. Government and Corporate Bonds

What are they?

Loans to governments or companies that pay fixed interest.

Pros:

- Lower risk than stocks.

- Predictable income.

Cons:

- Lower returns (~2-5% annually).

Comparison Table: UK Investment Options for Beginners

| Investment Type | Risk Level | Potential Returns | Minimum Investment | Liquidity |

|---|---|---|---|---|

| Stocks and Shares ISA | Medium | 5-10% | £100 | High |

| ETFs/Index Funds | Low-Medium | 4-8% | £50 | High |

| Robo-Advisors | Low-Medium | 3-7% | £500 | Medium |

| REITs | Medium | 6-8% | £1,000 | Medium |

| Government Bonds | Low | 2-4% | £100 | Medium |

How to Start Investing in the UK

- Set Clear Goals: Define short-term (1-3 years) vs. long-term (5+ years) objectives.

- Choose a Platform: Compare fees on platforms like AJ Bell or eToro.

- Diversify: Allocate funds across assets.

- Monitor and Adjust: Review portfolios annually.

Managing Risks

- Emergency Fund: Save 3-6 months’ expenses before investing.

- Avoid High-Risk Assets Early: Cryptocurrencies or penny stocks.

- Stay Informed: Follow market trends via BBC Business or Financial Times.

Tools and Resources

- Apps: Moneybox (micro-investing), Plum (automated savings).

- Courses: Udemy’s “Investing 101” or free modules on Investopedia.

- Regulatory Bodies: FCA (Financial Conduct Authority) for scam checks.

Case Study: Sarah’s Investment Journey

Sarah, 28, started with a £200/month Stocks and Shares ISA and a robo-advisor. Over 3 years, her portfolio grew by 22%, funding her home deposit.

FAQ Section

Q1: What’s the safest investment for beginners?

A: Government bonds or cash ISAs offer low-risk options.

Q2: How much do I need to start investing?

A: Some platforms allow £50/month. Start small and scale up.

Q3: Are cryptocurrencies safe for beginners?

A: High volatility makes them risky. Allocate <5% of your portfolio if curious.

Q4: Do I pay taxes on investments?

A: ISAs are tax-free. Outside ISAs, Capital Gains Tax applies above £6,000 annually.

Q5: Should I use a financial advisor?

A: Useful for complex goals, but robo-advisors suffice for most beginners.

Conclusion

The UK offers a wealth of opportunities for new investors, from ISAs to property.

By starting early, diversifying, and leveraging tax-efficient accounts, you can build a resilient portfolio.

Ready to take control of your financial future? Begin today by exploring our [Free Investment Toolkit] or sharing your questions in the comments below!

SEO Elements:

- Primary Keyword: Investment Opportunities for Beginners in UK

- Secondary Keywords: how to start investing UK, best investments for beginners, UK investment guide