Meta Description:

Learn how to improve your credit score in the USA with actionable tips, expert advice, and proven strategies.

Boost your financial health today!

Introduction

Your credit score is more than just a number—it’s a gateway to financial opportunities.

Whether you’re applying for a mortgage, car loan, or even a new credit card, a strong credit score can save you thousands of dollars in interest and open doors to better financial products.

In the USA, where credit scores play a pivotal role in financial decisions, understanding how to improve your credit score is essential.

This guide will walk you through everything you need to know about improving your credit score, from understanding how it’s calculated to actionable steps you can take today.

Let’s dive in!

What Is a Credit Score and Why Does It Matter?

Understanding Credit Scores

Your credit score is a three-digit number that represents your creditworthiness.

In the USA, the most commonly used credit scoring models are FICO® and VantageScore®, which range from 300 to 850.

The higher your score, the better your chances of securing loans and credit at favorable terms.

Why Your Credit Score Matters

A good credit score can:

- Help you qualify for lower interest rates on loans and credit cards.

- Increase your chances of approval for rental applications.

- Reduce insurance premiums in some cases.

- Even impact job opportunities, as some employers check credit history.

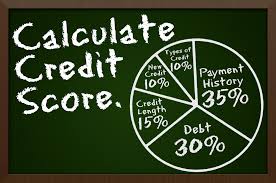

How Is Your Credit Score Calculated?

Your credit score is determined by several factors, each with a different weight:

- Payment History (35%): Your track record of paying bills on time.

- Credit Utilization (30%): The amount of credit you’re using compared to your total credit limit.

- Length of Credit History (15%): How long you’ve had credit accounts open.

- Credit Mix (10%): The variety of credit accounts you have (e.g., credit cards, mortgages, loans).

- New Credit (10%): Recent credit inquiries and newly opened accounts.

Understanding these factors is the first step toward improving your credit score.

How to Improve Your Credit Score: Actionable Steps

1. Pay Your Bills on Time

Your payment history is the most significant factor affecting your credit score.

Late payments can stay on your credit report for up to seven years. To avoid missed payments:

- Set up automatic payments or reminders.

- Prioritize paying at least the minimum amount due.

2. Reduce Your Credit Utilization Ratio

Aim to use less than 30% of your available credit, and ideally below 10%. For example, if your credit limit is $10,000, try to keep your balance under $3,000. You can achieve this by:

- Paying down existing balances.

- Requesting a credit limit increase (without increasing spending).

3. Avoid Closing Old Credit Accounts

The length of your credit history matters.

Closing old accounts can shorten your credit history and increase your credit utilization ratio.

Instead, keep them open and use them occasionally to maintain activity.

4. Diversify Your Credit Mix

Having a mix of credit types (e.g., credit cards, installment loans, mortgages) can positively impact your score.

However, only take on new credit if you can manage it responsibly.

5. Limit Hard Inquiries

Each time you apply for new credit, a hard inquiry is recorded on your credit report.

Too many hard inquiries in a short period can lower your score.

Be strategic about applying for new credit.

6. Monitor Your Credit Report Regularly

Errors on your credit report can drag down your score. You’re entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com.

Review your reports for inaccuracies and dispute any errors.

How Long Does It Take to Improve Your Credit Score?

Improving your credit score is a marathon, not a sprint. Here’s a general timeline:

| Action | Timeframe for Impact |

|---|---|

| Paying bills on time | 1-2 months |

| Reducing credit utilization | 1-2 billing cycles |

| Disputing credit report errors | 30-60 days |

| Building credit history | 6+ months |

Common Myths About Credit Scores

Myth 1: Checking Your Credit Score Lowers It

Fact: Checking your own credit score is a soft inquiry and does not affect your score.

Myth 2: Closing Credit Cards Improves Your Score

Fact: Closing credit cards can hurt your score by increasing your credit utilization ratio and shortening your credit history.

Myth 3: You Only Have One Credit Score

Fact: You have multiple credit scores, as different lenders and credit bureaus use varying scoring models.

Tools and Resources to Help You Improve Your Credit Score

- Credit Monitoring Services: Platforms like Credit Karma and Experian offer free credit monitoring and alerts.

- Budgeting Apps: Tools like Mint and YNAB can help you manage your finances and pay bills on time.

- Credit Counseling: Nonprofit organizations like the National Foundation for Credit Counseling (NFCC) provide free or low-cost advice.

Frequently Asked Questions (FAQs)

1. How often should I check my credit score?

It’s a good idea to check your credit score at least once a year.

If you’re actively working on improving your score, consider checking it monthly.

2. Can I remove negative items from my credit report?

Negative items like late payments can only be removed if they’re inaccurate.

You can dispute errors with the credit bureaus.

3. Will paying off collections improve my score?

Paying off collections can help, but the impact depends on the scoring model. Some newer models ignore paid collections.

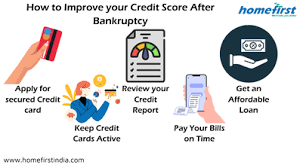

4. How does bankruptcy affect my credit score?

Bankruptcy can significantly lower your score and remain on your credit report for 7-10 years. However, you can rebuild your score over time.

5. Can I improve my credit score without a credit card?

Yes, you can build credit through other means, such as secured loans, credit-builder loans, or becoming an authorized user on someone else’s account.

6. What’s the fastest way to improve my credit score?

Paying down high credit card balances and disputing errors on your credit report are among the fastest ways to see improvement.

7. Does renting an apartment affect my credit score?

Typically, rent payments don’t affect your credit score unless your landlord reports them to the credit bureaus or you use a rent-reporting service.

Conclusion

Improving your credit score in the USA is a powerful step toward achieving financial stability and unlocking opportunities.

By understanding how your credit score is calculated and implementing the strategies outlined in this guide, you can take control of your financial future.

Remember, building a strong credit score takes time and discipline, but the rewards are well worth the effort.

Start today by reviewing your credit report, paying down balances, and making timely payments.

Call-to-Action:

Have questions or tips about improving your credit score? Share your thoughts in the comments below or explore our other articles on personal finance.

Don’t forget to share this guide with friends and family who might benefit from it!

SEO Elements:

- Primary Keyword: Improve Credit Score in USA

- Secondary Keywords: credit score tips, boost credit score, credit report errors

- Alt Text for Images: “Woman reviewing credit score on laptop”

- Internal Links: How to Build Credit from Scratch, Best Credit Cards for Bad Credit

- External Links: AnnualCreditReport.com, National Foundation for Credit Counseling

By following this guide, you’ll be well on your way to improving your credit score and achieving your financial goals. Happy credit building!