Meta Description:

Discover 10 actionable strategies to boost your credit score in the USA, UK, Canada, and India. Learn how to build better credit and achieve financial freedom today!

Introduction

Your credit score is more than just a number—it’s a gateway to financial opportunities. Whether you’re applying for a mortgage, a car loan, or even a credit card, a strong credit score can save you thousands of dollars in interest and open doors to better financial products.

But what if your credit score isn’t where you want it to be? Don’t worry; improving your credit score is entirely possible with the right strategies.

In this comprehensive guide, we’ll explore 10 proven ways to improve your credit score in the USA, UK, Canada, and India.

From understanding how credit scores work to actionable tips you can implement today, this article is your roadmap to better credit health. Let’s dive in!

1. Understand How Credit Scores Work

Before you can improve your credit score, it’s essential to understand how it’s calculated. While the exact formulas vary by country, the core factors are similar:

- Payment History (35-40%): Your track record of paying bills on time.

- Credit Utilization (20-30%): The percentage of available credit you’re using.

- Length of Credit History (15-20%): How long you’ve had credit accounts.

- Credit Mix (10%): The variety of credit types (e.g., credit cards, loans).

- New Credit Inquiries (10%): How often you apply for new credit.

Understanding these factors will help you prioritize which areas to focus on.

2. Pay Your Bills on Time, Every Time

Your payment history is the most significant factor affecting your credit score. Even one missed payment can have a negative impact. Here’s how to stay on track:

- Set up automatic payments for recurring bills.

- Use calendar reminders for due dates.

- Contact lenders immediately if you’re struggling to make a payment—they may offer a grace period or payment plan.

Pro Tip: In the USA, tools like Experian Boost can help you include utility and phone bill payments in your credit report, potentially boosting your score.

3. Reduce Your Credit Utilization Ratio

Your credit utilization ratio measures how much of your available credit you’re using. Experts recommend keeping this below 30%, and ideally under 10%, for the best impact on your score.

- Pay down existing balances.

- Request a credit limit increase (but avoid spending more).

- Spread out spending across multiple cards to keep individual utilization low.

Example: If you have a $10,000 credit limit and a $3,000 balance, your utilization is 30%. Paying it down to $1,000 reduces it to 10%.

4. Avoid Closing Old Credit Accounts

The length of your credit history matters. Closing old accounts can shorten your credit history and reduce your available credit, both of which can hurt your score.

- Keep old accounts open, even if you don’t use them often.

- Use them occasionally for small purchases to keep them active.

Note: In India, credit bureaus like CIBIL consider the age of your oldest credit account, so preserving old accounts is crucial.

5. Diversify Your Credit Mix

Having a mix of credit types—such as credit cards, personal loans, and mortgages—can positively impact your score. It shows lenders you can manage different types of credit responsibly.

- If you only have credit cards, consider a small installment loan.

- Avoid taking on new debt just to diversify your credit mix.

6. Limit Hard Inquiries on Your Credit Report

Every time you apply for new credit, a hard inquiry is recorded on your credit report. Too many hard inquiries in a short period can lower your score.

- Only apply for credit when necessary.

- Check if a lender offers pre-approval with a soft inquiry, which doesn’t affect your score.

Did You Know? In the UK, multiple mortgage inquiries within a short period are often treated as a single inquiry to minimize the impact on your score.

7. Monitor Your Credit Report Regularly

Errors on your credit report can drag down your score. Regularly reviewing your report allows you to spot and dispute inaccuracies.

- USA: Get free annual credit reports from Equifax, Experian, and TransUnion.

- UK: Use services like ClearScore or CheckMyFile.

- Canada: Request free reports from Equifax and TransUnion.

- India: Access your CIBIL report online.

Common Errors to Look For:

- Incorrect personal information.

- Accounts you didn’t open.

- Duplicate accounts.

8. Become an Authorized User

If you’re new to credit or rebuilding your score, becoming an authorized user on someone else’s credit card can help. Their positive payment history can boost your score.

- Choose someone with a strong credit history and low credit utilization.

- Ensure the card issuer reports authorized user activity to credit bureaus.

9. Use Credit-Building Tools

Several tools and services are designed to help you build or rebuild credit:

- USA: Secured credit cards, credit-builder loans, and Experian Boost.

- UK: Credit builder cards and loans from providers like Loqbox.

- Canada: Secured credit cards and credit-building programs.

- India: Secured credit cards and small personal loans.

Example: A secured credit card requires a cash deposit, which serves as your credit limit. Responsible use can help build your score over time.

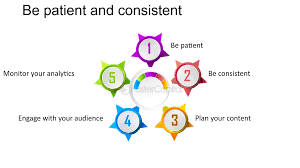

10. Be Patient and Consistent

Improving your credit score is a marathon, not a sprint. It takes time to see significant changes, but consistent effort pays off.

- Stick to good credit habits.

- Avoid quick-fix schemes that promise instant results.

Comparison Table: Credit Score Ranges by Country

| Country | Excellent Score Range | Good Score Range | Fair Score Range | Poor Score Range |

|---|---|---|---|---|

| USA | 800-850 | 670-799 | 580-669 | 300-579 |

| UK | 881-999 | 721-880 | 561-720 | 0-560 |

| Canada | 800-900 | 720-799 | 650-719 | 300-649 |

| India | 750-900 | 700-749 | 650-699 | 300-649 |

FAQs

1. How long does it take to improve a credit score?

It depends on your starting point, but you can see small improvements in as little as 1-2 months. Significant changes may take 6-12 months or longer.

2. Will checking my credit score lower it?

No, checking your own credit score is a soft inquiry and doesn’t affect your score.

3. Can I improve my credit score without a credit card?

Yes, options like credit-builder loans and becoming an authorized user can help.

4. How often should I check my credit report?

At least once a year, or more frequently if you’re actively working on improving your score.

5. What’s the fastest way to improve my credit score?

Paying down high balances and correcting errors on your credit report can yield quick results.

6. Does closing a credit card hurt my score?

It can, especially if it’s an old account or reduces your available credit.

7. Can I improve my credit score after bankruptcy?

Yes, but it takes time. Focus on rebuilding with secured credit cards and consistent payments.

Conclusion

Improving your credit score is one of the most impactful steps you can take toward financial stability.

By following these 10 proven strategies, you can boost your credit score in the USA, UK, Canada, or India—no matter where you’re starting from.

Remember, consistency is key, and small changes can lead to significant results over time.

Ready to take control of your credit? Start by checking your credit report today and identifying areas for improvement.

Share this guide with friends and family, and let’s build better credit together!

SEO Elements:

- Primary Keyword: Improve Your Credit Score

- Secondary Keywords: Credit Score Tips, Boost Credit Score, Credit Score Improvement

- Alt Text for Images: “Credit score improvement tips for USA, UK, Canada, and India”

- Internal Linking: Link to related articles on financial planning and debt management.

- External Linking: Link to official credit bureau websites and authoritative financial resources.

By following this guide, you’ll not only improve your credit score but also gain the financial confidence to achieve your goals. Happy credit building!