Meta Description: Discover the 10 best investment options for beginners in the USA, UK, Canada, and India. Learn how to start investing wisely with this comprehensive guide.

Introduction

Investing can seem daunting, especially for beginners. With so many options available, it’s easy to feel overwhelmed.

But here’s the good news: you don’t need to be a financial expert to start building wealth. Whether you’re in the USA, UK, Canada, or India, there are beginner-friendly investment options tailored to your needs.

This guide will walk you through the 10 best investment options for beginners, helping you make informed decisions and take your first steps toward financial growth. Let’s dive in!

Why Should Beginners Start Investing?

The Power of Compound Interest

Albert Einstein once called compound interest the “eighth wonder of the world.” When you invest early, your money grows exponentially over time.

For example, investing just $100 a month with a 7% annual return can grow to over $50,000 in 20 years.

Beat Inflation

Inflation erodes the value of your money over time. By investing, you can grow your wealth faster than inflation, ensuring your purchasing power remains intact.

Achieve Financial Goals

Whether it’s buying a home, funding your child’s education, or retiring comfortably, investing helps you achieve your long-term financial goals.

10 Best Investment Options for Beginners

1. Stock Market Investments

The stock market is one of the most popular investment avenues. Beginners can start with:

- Blue-chip stocks: Shares of well-established companies like Apple or Amazon.

- Index funds: Funds that track market indices like the S&P 500.

Why it’s great for beginners:

- Potential for high returns.

- Easy to buy and sell through online platforms.

Tip: Use apps like Robinhood (USA) or Groww (India) to start with small amounts.

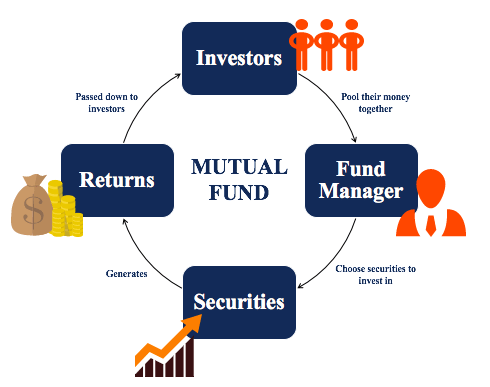

2. Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

Types of mutual funds:

- Equity funds (higher risk, higher returns).

- Debt funds (lower risk, steady returns).

- Hybrid funds (a mix of both).

Why it’s great for beginners:

- Professionally managed.

- Diversification reduces risk.

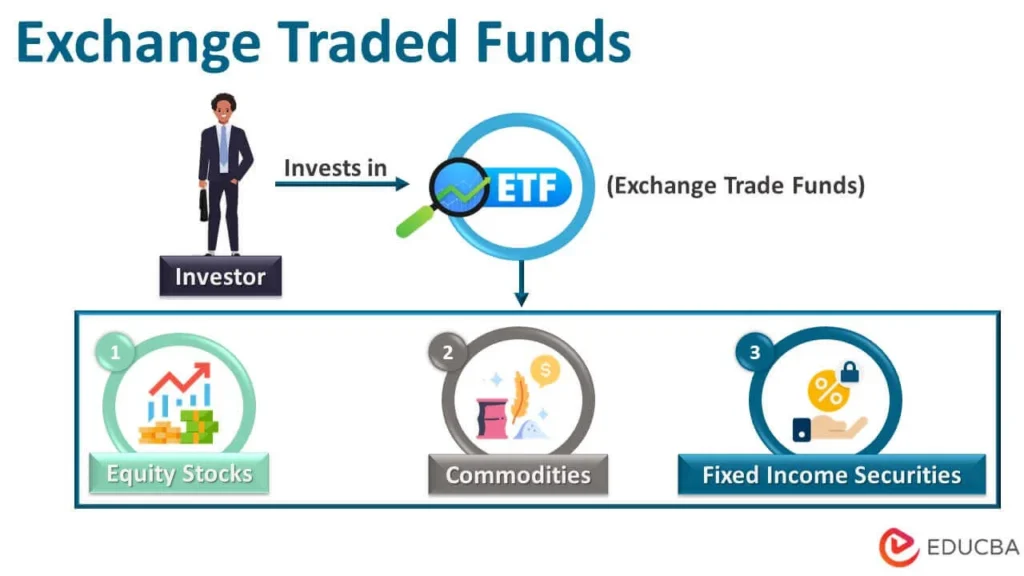

3. Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade like stocks on exchanges. They offer diversification and lower fees.

Popular ETFs:

- SPDR S&P 500 ETF (USA).

- Vanguard FTSE All-World ETF (UK).

- Nippon India ETF Nifty BeES (India).

Why it’s great for beginners:

- Low expense ratios.

- Flexibility to trade throughout the day.

4. Real Estate Investments

Real estate can be a lucrative investment, especially in growing markets. Beginners can start with:

- REITs (Real Estate Investment Trusts): Invest in real estate without owning property.

- Crowdfunding platforms: Pool funds with other investors to buy properties.

Why it’s great for beginners:

- Passive income through rentals.

- Long-term appreciation potential.

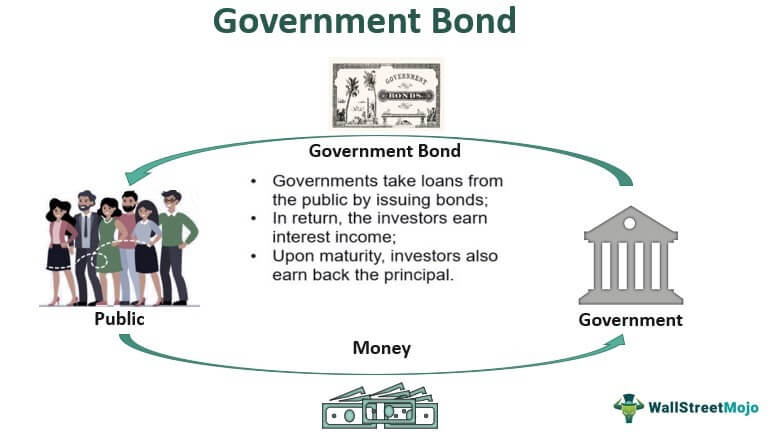

5. Government Bonds

Government bonds are low-risk investments where you lend money to the government in exchange for periodic interest payments.

Examples:

- US Treasury Bonds (USA).

- Gilts (UK).

- Government Securities (India).

Why it’s great for beginners:

- Guaranteed returns.

- Ideal for conservative investors.

6. High-Yield Savings Accounts

A high-yield savings account offers higher interest rates than traditional savings accounts.

Top options:

- Ally Bank (USA).

- Marcus by Goldman Sachs (UK).

- ICICI Bank (India).

Why it’s great for beginners:

- No risk to principal.

- Easy access to funds.

7. Retirement Accounts

Retirement accounts like 401(k)s (USA) or RRSPs (Canada) offer tax advantages for long-term savings.

Why it’s great for beginners:

- Employer matching contributions (in some cases).

- Tax-deferred growth.

8. Cryptocurrency

Cryptocurrencies like Bitcoin and Ethereum have gained popularity as high-risk, high-reward investments.

Why it’s great for beginners:

- Potential for massive returns.

- Easy to buy through platforms like Coinbase or Binance.

Tip: Invest only what you can afford to lose.

9. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers with investors. You earn interest on the loans you fund.

Popular platforms:

- LendingClub (USA).

- Funding Circle (UK).

- Faircent (India).

Why it’s great for beginners:

- Higher returns than traditional savings.

- Diversification across multiple loans.

10. Gold and Precious Metals

Gold has been a safe-haven investment for centuries. Beginners can invest in:

- Physical gold (coins, bars).

- Gold ETFs or mutual funds.

Why it’s great for beginners:

- Hedge against inflation.

- Low correlation with stock markets.

Comparison Table: Best Investment Options for Beginners

| Investment Option | Risk Level | Potential Returns | Liquidity | Best For |

|---|---|---|---|---|

| Stock Market | High | High | High | Long-term growth |

| Mutual Funds | Medium | Medium-High | Medium | Diversification |

| ETFs | Medium | Medium-High | High | Low-cost diversification |

| Real Estate | Medium-High | Medium-High | Low | Passive income |

| Government Bonds | Low | Low-Medium | Medium | Conservative investors |

| High-Yield Savings | Low | Low | High | Emergency funds |

| Retirement Accounts | Low-Medium | Medium | Low | Long-term savings |

| Cryptocurrency | Very High | Very High | High | High-risk tolerance |

| Peer-to-Peer Lending | Medium-High | Medium-High | Medium | Alternative income |

| Gold | Low-Medium | Medium | Medium | Inflation hedge |

FAQs

1. What is the best investment for beginners?

For most beginners, index funds or ETFs are ideal due to their diversification and low costs.

2. How much money do I need to start investing?

You can start with as little as $50 or ₹500, depending on the investment option.

3. Is cryptocurrency safe for beginners?

Cryptocurrency is highly volatile and risky. Beginners should invest only a small portion of their portfolio.

4. What is the safest investment option?

Government bonds and high-yield savings accounts are among the safest options.

5. How do I choose the right investment?

Consider your financial goals, risk tolerance, and investment horizon. Consulting a financial advisor can also help.

6. Can I invest in multiple options at once?

Yes, diversifying across multiple investment options reduces risk and maximizes returns.

7. What are the tax implications of investing?

Taxes vary by country and investment type. For example, long-term capital gains are often taxed lower than short-term gains.

Conclusion

Investing is a powerful tool for building wealth, and it’s never too early to start. By exploring these 10 best investment options for beginners, you can take control of your financial future.

Remember, the key to successful investing is to start small, stay consistent, and keep learning.

Ready to take the first step? Share this guide with friends or leave a comment below with your questions. Happy investing!

SEO Elements:

- Primary Keyword: Best Investment Options for Beginners

- Secondary Keywords: beginner-friendly investments, how to start investing, low-risk investments

- Meta Tags: Optimized for search engines.

- Alt Text for Images: Descriptive and keyword-rich.

- Internal Linking: Links to related articles on investing basics.

- External Linking: Links to authoritative sources like Investopedia and government financial websites.

This article is designed to be visually appealing, user-friendly, and optimized for search engines, making it a valuable resource for beginners in Tier 1 countries.